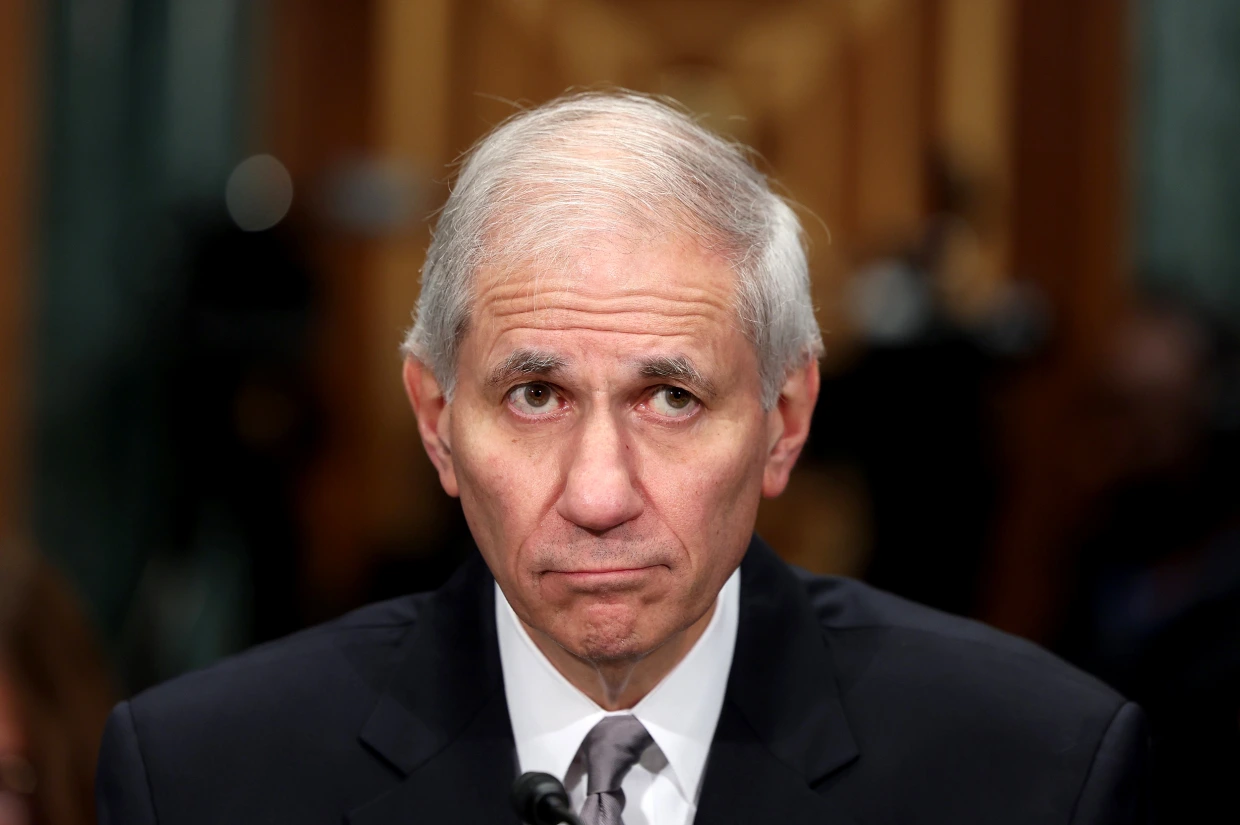

“In light of recent events, I am prepared to step down from my responsibilities once a successor is confirmed,” Gruenberg announced on Monday. “Until that time, I will continue to fulfill my responsibilities as Chairman of the FDIC, including the transformation of the FDIC’s workplace culture.”

Gruenberg’s decision to resign follows calls for “new leadership” from Sen. Sherrod Brown, a top Democrat who leads the Senate Banking Committee. Gruenberg has been with the FDIC board for nearly two decades and has served as chair for almost 10 of the past 13 years.

President Joe Biden will soon announce a new nominee to lead the FDIC, according to White House Deputy Press Secretary Sam Michel. “We expect the Senate to confirm the nominee quickly,” Michel stated, although the confirmation process can be lengthy.

Gruenberg will remain in his position until a successor is confirmed, preventing Vice Chair Travis Hill, a Republican appointee, from automatically becoming chair and potentially deadlocking the FDIC’s board. This move ensures continuity and prevents delays in implementing significant banking regulations.

The administration expressed gratitude for Gruenberg’s willingness to stay on during the transition period. However, Sen. Tim Scott, the top-ranking Republican on the Senate Banking Committee, criticized Gruenberg’s decision to stay on temporarily, accusing the administration of prioritizing a political agenda over worker protection.

The FDIC’s decision for Gruenberg to resign followed a report by law firm Cleary Gottlieb Steen & Hamilton, which confirmed the findings of a November Wall Street Journal investigation. The report documented a problematic culture at the FDIC but did not hold Gruenberg solely responsible for the issues. It noted instances where Gruenberg’s reactions to bad news caused staffers to delay delivering updates, potentially hindering meaningful cultural change.

Gruenberg testified before lawmakers last week, acknowledging his responsibility for the findings. “I also acknowledge my own failures as Chairman, both in failing to recognize how my temperament in meetings impacted others and for not having identified deeper cultural issues at the FDIC sooner,” he said.

The FDIC declined to comment further beyond Gruenberg’s statement.

### Political Reactions and Implications

While most Democrats stopped short of calling for Gruenberg’s immediate resignation, many expressed outrage during mid-May hearings where Gruenberg testified. Rep. Gregory Meeks, a New York Democrat, expressed his frustration, saying, “I’m pissed off… If it was me in my office, I’d probably be run out.”

Democratic Sen. Elizabeth Warren argued that calls for Gruenberg’s resignation were a “purely political exercise” and stated that his resignation would not improve the FDIC’s culture but would instead give Republicans more influence over bank policy. She suggested that it would be sufficient for Gruenberg to implement the report’s recommendations.

This article has been updated with additional context and developments.