Trump Media reported a loss of $327.6 million in the first three months of the year, mainly due to one-time losses linked to the company going public earlier this year. The company had a loss of $210,300 during the same period last year. The significant losses were attributed to non-cash expenses from converting promissory notes and eliminating previous liabilities.

The company also reported an operating loss of $12.1 million, with a significant portion driven by one-time payments related to the merger with a blank-check company earlier this year. Despite these losses, the company generated only $770,500 in revenue, marking the second consecutive quarter with less than $1 million in revenue.

Matthew Kennedy, senior IPO market strategist at Renaissance Capital, emphasized the unusual nature of a company with such minimal revenue having such a high valuation. In the press release, Trump Media stated that at this “early stage” in its development, the company is focused on long-term product development rather than quarterly revenue. It acknowledged that its advertising business is just beginning and expressed confidence that new products like streaming would improve future results.

However, Kennedy noted that if the company is not focused on revenue, public investors have little to rely on for evaluating the company’s progress. Trump Media does not provide user metrics, though app downloads or Trump’s followers could be considered. Investors need to place a lot of trust in the company, which can be volatile, as seen in early April.

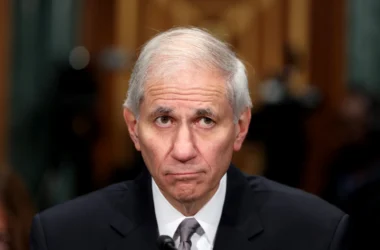

Trump Media asserted that it has “sufficient” cash to fund the business “for the foreseeable future,” listing a cash balance of $274 million at the end of March, bolstered by the public listing deal. Trump Media CEO Devin Nunes stated that after an extensive merger process, the company is well-capitalized and supported by retail shareholders who believe in its mission to counter Big Tech censorship. Nunes also mentioned that the company’s cash balance allows for exploring potential mergers and acquisitions.

Experts have questioned the logic behind Trump Media’s stock price, given its financial results and limited social media presence. Jay Ritter, a finance professor at the University of Florida, pointed out that the company’s revenue remains minimal. Despite having ample cash reserves, the company is not generating significant revenue, indicating no imminent profitability.

Truth Social, Trump Media’s social network, remains a minor player in social media. In April, it experienced a 19% year-over-year drop in average daily active U.S. users on iOS and Android, totaling just 113,000 users, according to market research firm Similarweb. In comparison, rival X (formerly Twitter) had over 34 million users, and Instagram’s Threads had 3.5 million.

Trump Media’s financials were reviewed by Semple, Marchal & Cooper, its new accounting firm. The company’s previous accounting firm was accused of “massive fraud” by federal regulators this month, though Trump Media was not implicated in the charges against the auditor.